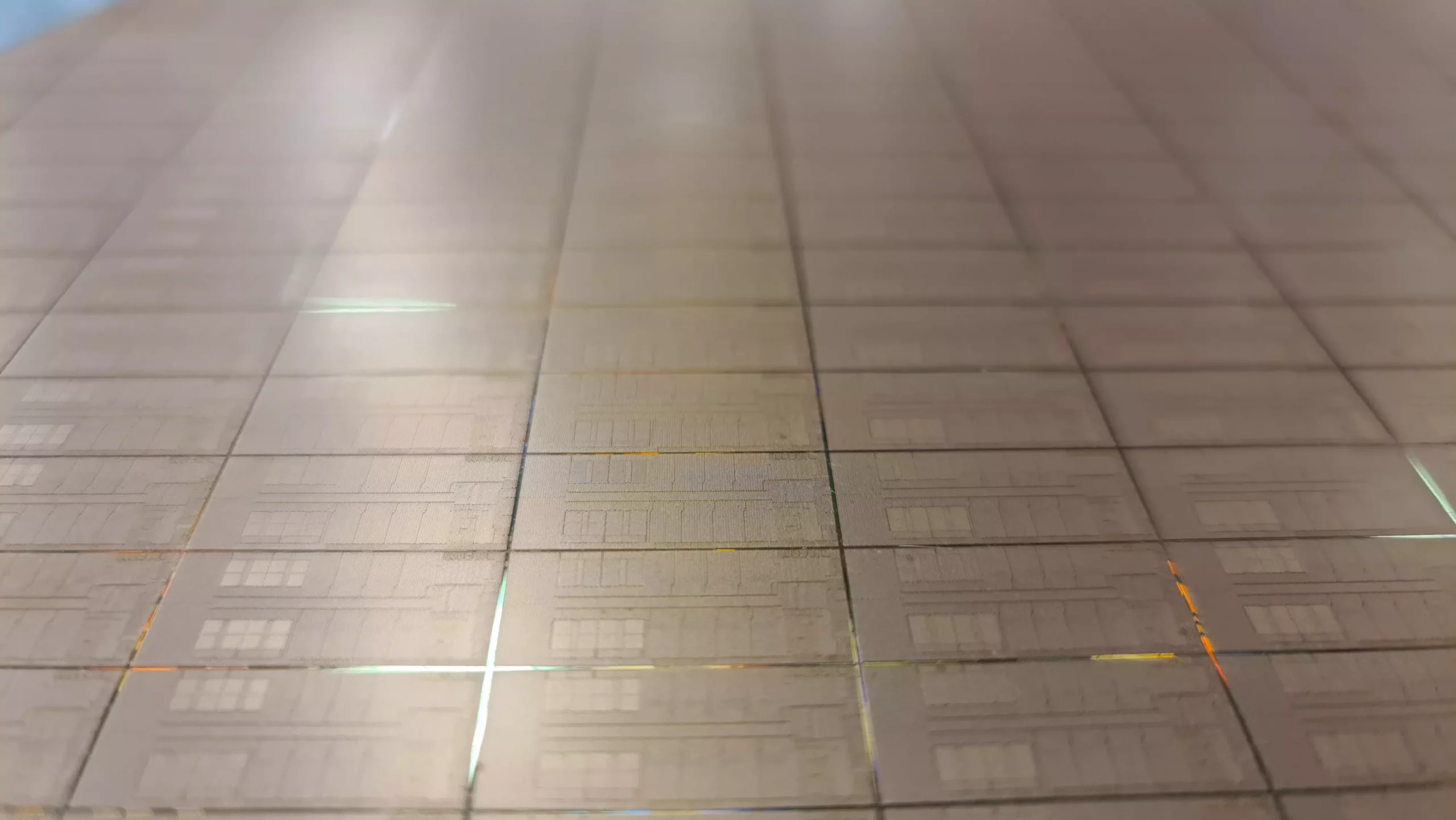

Intel’s recent decision to sell 51% of its stake in Altera, a pioneer in programmable logic devices, marks a significant turning point in the semiconductor industry. This move, valued at $8.75 billion, signifies not merely a financial transaction, but a fundamental shift in Intel’s strategy and a reflection of the evolving digital landscape. Altera, which became part of Intel’s sprawling portfolio in 2015 for a staggering $16.7 billion, has long been recognized for its field-programmable gate arrays (FPGAs) that cater to increasingly complex technological demands. As the world pivots toward more adaptable and bespoke semiconductor solutions, Altera’s prominence in this space cannot be overstated.

The collaboration between Intel and Altera dates back to before the acquisition, and their shared technology has been a hallmark of innovative products. However, as technological landscapes shift and competition intensifies, the necessity for Intel to refocus on its core competencies has become apparent. This sale to Silver Lake, a global investment firm renowned for its technology investments, thus reflects not just a financial strategy but an insight into Intel’s future direction.

Analyzing the Valuation Shift

The timing of this divestiture raises eyebrows, particularly considering the valuation drop from $16.7 billion to $8.75 billion for Altera within just eight years. While the decrease may initially appear alarming, one must adopt a broader perspective. Intel isn’t merely offloading an asset; it is strategically repositioning itself within a sector that demands agility and focus. $4 billion for a controlling interest in a chipmaking entity still suggests substantial value, especially given the ever-increasing demand for semiconductor solutions across diverse industries.

Retaining 49% ownership allows Intel to maintain influence, which could be seen as a safeguard against the unpredictable volatility of the semiconductor market. It provides a balance between divesting operational control and preserving a one-foot-in-the-door stance in a rapidly evolving technological realm. The nuance of this transaction lies in its acknowledgment that while innovation in FPGAs is critical, Intel’s immediate priorities may lie elsewhere.

Silver Lake: A Strategic Partner for Growth

Contrary to the perhaps misleading similarities in their names, Silver Lake is not a subsidiary of Intel. Yet, their collaboration has the potential to yield fruitful results for both parties. With a formidable history of investing in tech giants and scaling innovative companies, Silver Lake is well-equipped to navigate Altera’s independence. Their investment philosophy emphasizes not just financial returns but strategic growth, fostering an environment where Altera can thrive independently yet collaboratively.

Recent ventures, including major investments in high-profile tech companies like Twitter and Airbnb, emphasize Silver Lake’s capabilities in enhancing market value through strategic partnerships. Thus, this deal represents more than just an investment; it is an opportunity for Altera to accelerate its innovation trajectory away from the larger Intel umbrella.

The Future of Altera as an Independent Entity

The appointment of Raghib Hussain as the new CEO of Altera indicates a fresh start for the company. Transitioning from being an Intel division to a standalone enterprise presents challenges and opportunities alike. Hussain’s experience at Marvell and deep knowledge of product development and technology positions him as a capable leader to guide Altera into this new era.

However, the essence of independence here is worth investigating further. While strategic partnerships can offer advantages, presiding influence by Intel remains a critical element to watch. How independent can Altera truly become while retaining significant backing from a tech giant? This question echoes the sentiments of many within the industry, who recognize that autonomy can invigorate innovation, but too much proximity to a parent company may hinder that freedom.

As we await the unfolding of events following this significant transaction, stakeholders across the semiconductor domain will undoubtedly keep a close eye on how Altera navigates its fresh landscape. The juxtaposition of Intel’s broader strategic restructuring alongside Altera’s leap into independence presents a compelling narrative of resilience and adaptation in the technology sector. This juncture could very well redefine success metrics and operational dynamics within the semiconductor ecosystem.

Leave a Reply