The semiconductor industry operates under a complex web of regulations and international trade agreements that significantly impact how companies operate across borders. One such event that has brought this web into sharp focus is the recent disclosure by GlobalFoundries, a leading semiconductor manufacturer, regarding its shipments to a designated Chinese entity, SJ Semiconductor. The incident sheds light on the broader challenges faced by U.S. companies in navigating the increasingly tense U.S.-China trade relations, particularly regarding sensitive technologies.

GlobalFoundries was once a part of AMD’s manufacturing division, but it has since carved out a significant standing as the third-largest semiconductor foundry globally by revenue. The company’s operations span various sectors, including smart mobile devices, automotive, aerospace, defense, and data centers. The significance of this role cannot be overstated, as semiconductors are critical to powering modern technology and efficient operations in many industries. However, the geopolitical and regulatory landscapes surrounding semiconductor manufacturing have become fraught with complexities, making compliance a critical concern for companies like GlobalFoundries.

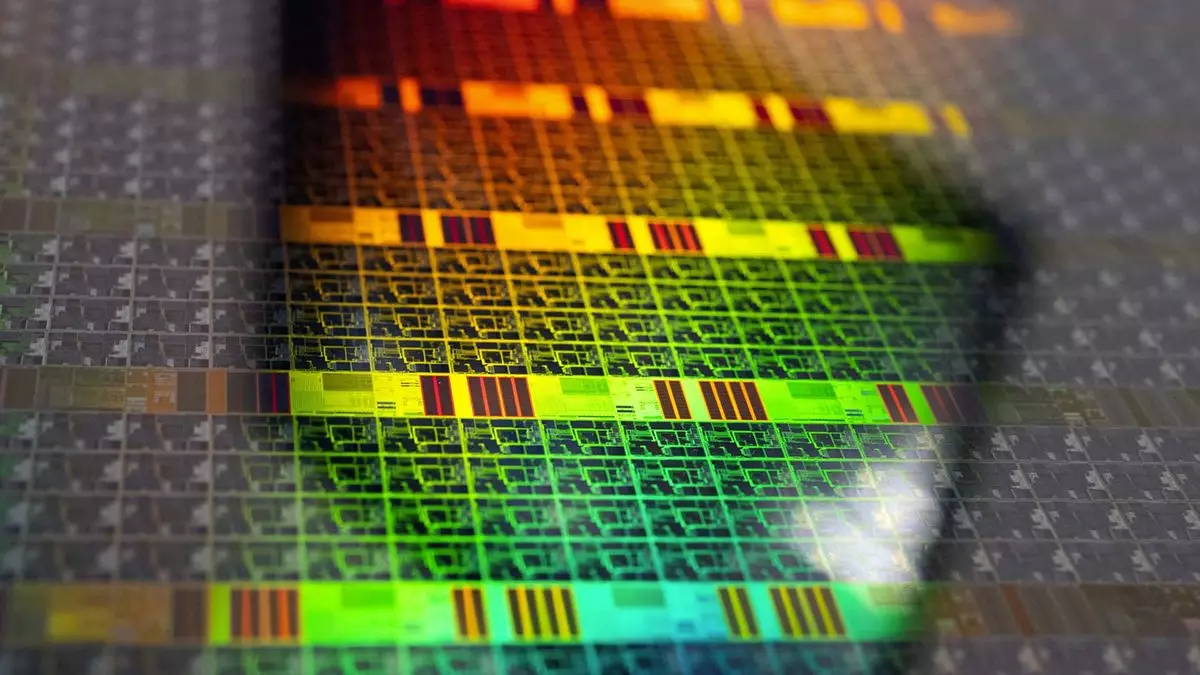

Among the recent revelations is GlobalFoundries’ admission to shipping approximately $17 million worth of semiconductor wafers to SJ Semiconductor between February 2021 and October 2022. This action breached U.S. trade restrictions aimed at preventing critical technologies from reaching companies tied to the Chinese military-industrial complex. The U.S. government, through the Bureau of Industry and Security (BIS), has taken a firm stance against companies that fail to adhere to these restrictions, imposing a $500,000 fine on GlobalFoundries for its actions. However, the working relationship between the company and the regulatory agencies appears somewhat collaborative, as GlobalFoundries voluntarily revealed the breach and has since cooperated with the investigation.

Strategic Responses from Regulatory Bodies

Matthew S. Axelrod, the Assistant Secretary for Export Enforcement, emphasized the importance of vigilance among U.S. companies when dealing with semiconductor sales to Chinese entities. This incident reflects a growing trend in which the U.S. government encourages transparency among companies, offering leniency in financial penalties for those that proactively report violations. While a $500,000 fine may seem minor in light of GlobalFoundries’ substantial revenue, it reflects a larger strategy to foster a culture of compliance and self-regulation within the industry.

The inclusion of SJ Semiconductor on the export regulation’s “entity list” in December 2020 signifies the broader U.S. government concerns about the strategic implications of semiconductor manufacturing in China. This case serves as a cautionary tale to other firms in the industry, illustrating the intricate balancing act they must perform in maintaining compliance while striving for business growth and operational success across international divides.

GlobalFoundries is not alone in its struggles. Reports have emerged implicating TSMC, another titan in the semiconductor space, in similar challenges, revealing that some of its chips may have inadvertently ended up in products made by Huawei, a company also on the U.S. entity list. The potential fallout for TSMC underscores the pervasive uncertainty in the semiconductor supply chain, where even minor oversights can lead to significant regulatory scrutiny and reputational damage.

The investigation into TSMC’s deliveries marks a crucial point in semiconductor trade compliance, as the firm has proactively halted shipments to implicated clients and notified governmental bodies. This response aligns with the new culture of accountability that U.S. agencies are attempting to instill in the semiconductor industry. As competition grows and the technology becomes increasingly intertwined with national security, companies must remain vigilant in their operations to avoid potential repercussions.

The recent developments surrounding GlobalFoundries and other semiconductor manufacturers illustrate the growing complexities and responsibilities that these companies face in today’s global marketplace. As tensions continue to rise in U.S.-China relations and trade regulations become more stringent, navigating compliance will remain a paramount concern. The semiconductor industry must adapt to these regulations while simultaneously striving for innovation and market growth, a challenging interplay that will define the future of technology and international business. The next steps for firms like GlobalFoundries will be pivotal in shaping not only their operational strategies but also the regulatory framework governing global semiconductor trade.

Leave a Reply