Intel’s foundry operations have been on the tip of everyone’s tongue lately, sparking discussions that ripple through the tech industry. The company finds itself at a crucial crossroads, grappling with an ongoing dependency on TSMC—the Taiwanese semiconductor titan—despite earlier ambitions to sever those ties. Recent remarks by John Pitzer, Intel’s VP of corporate planning and investor relations, illuminate a shift in strategy that places TSMC more firmly in Intel’s production line. This contradictory stance not only raises eyebrows but also poses pivotal questions about Intel’s operational future.

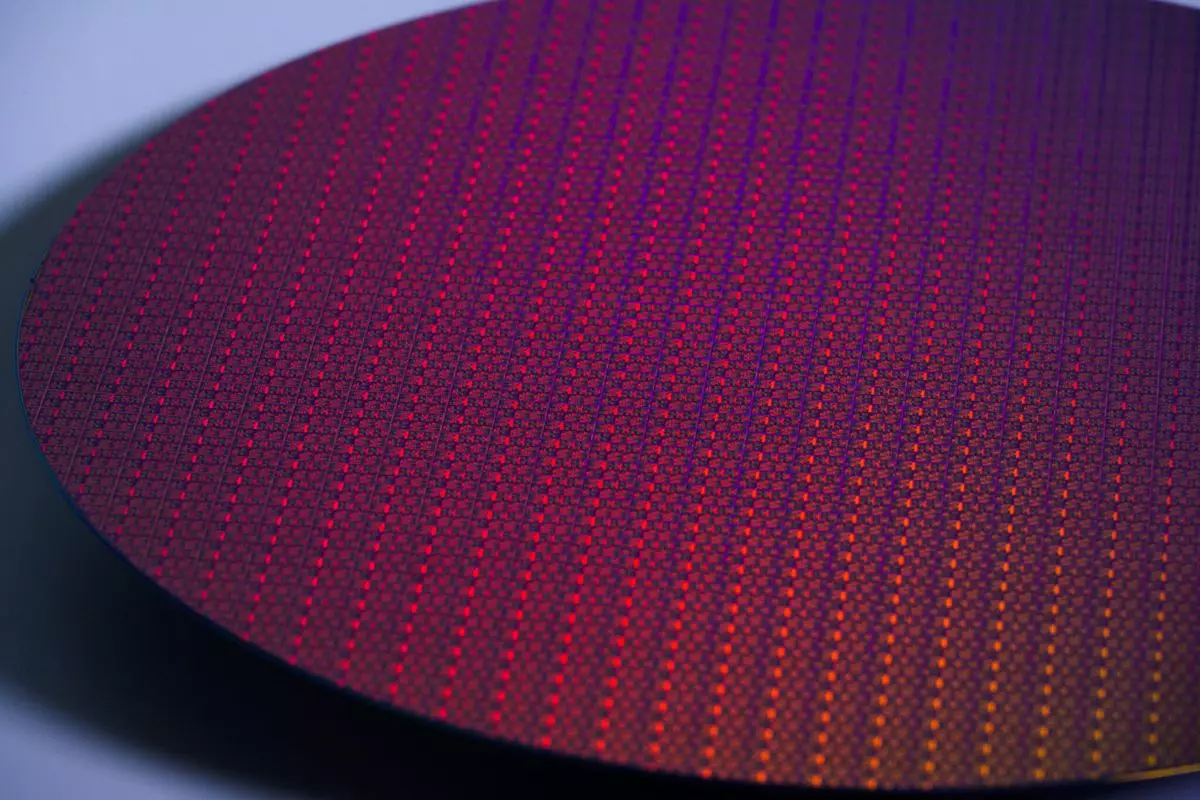

Pitzer candidly shared that approximately 30% of Intel’s silicon wafers are still sourced from TSMC, contradicting previous aspirations to bring this figure closer to zero. “It’s always good to have at least some of our wafers with TSMC,” Pitzer highlighted, promoting the notion of fostering a competitive atmosphere between in-house production and external suppliers. This strategic pivot unfolds against a backdrop of financial turbulence within Intel, emphasizing the fragility of its recovery plan.

Effect on Profit Margins and Market Dynamics

For a company that has prided itself on being a leader in semiconductor manufacturing, outsourcing substantial portions of its wafer production presents a double-edged sword. While utilizing TSMC’s advanced technology may accelerate product availability and performance—especially as Intel revamps its Panther Lake mobile CPU series—the economic implications could be severe. Pitzer himself recognized that reliance on external foundries could impact profit margins, engendering a series of financial complications that could further strain Intel’s already precarious position.

The complexities of supply chain economics also indicate that each wafer procured from a supplier outside the company raises costs that would inherently be lower if produced in-house. The margins lost further entrench Intel in a cycle of dependency at a time when the tech industry is clamoring for cost-effective solutions and swift advancements. This conundrum begs the question: is Intel inadvertently pushing itself into a corner from which it cannot easily escape?

The Leadership Conundrum and Changing Strategies

In light of the recent upheaval in leadership—most notably the departure of CEO Pat Gelsinger—Intel’s strategic direction appears muddled. With interim leaders Dave Zinsner and Michelle Johnston Holthaus at the helm, there is a palpable sense of uncertainty regarding how renewed strategies will be formed and executed. Pitzer’s admission that the level of TSMC’s involvement could remain at 30% for an indefinite period directly reflects a lack of decisive leadership in facilitating a radical shift.

Moreover, Gelsinger’s vision of cutting TSMC dependency to 20% now seems distant as rumors swirl about potential acquisitions of Intel’s fabs by companies like TSMC or even Broadcom. This speaks not only to the precariousness of Intel’s position but also to the entangled relationships in the semiconductor ecosystem. In a world where strategic partnerships can pivot swiftly, this intricate dance of dependency and competition does not bode well for a company needing to reclaim its dominance.

Speculation and Future Prospects

The chatter surrounding Intel’s next moves is as complex as the semiconductor business itself. As observers speculate whether TSMC may assume control over Intel’s fabrication facilities, one has to consider the implications of such a partnership. In a climate where competition is fierce and technology cycles are short, Intel’s reliance on TSMC could paradoxically empower its rival, creating a situation where the company is both dependent on and competing against a formidable force in the market.

However, there’s a silver lining—the operational realities of leveraging TSMC’s advanced processes may afford Intel a temporary reprieve from its manufacturing woes, buying time as it races to revitalize its own foundry capabilities. That being said, will this collaboration lead to long-term stability or just serve as a band-aid fix for Intel’s more substantial issues? The implications of this could resonate throughout the industry, potentially reshaping market dynamics for years to come.

With an eye on the rollercoaster of developments yet to unfold, the path forward seems multifaceted—and Intel’s journey will undoubtedly be one to watch closely as it endeavors to navigate its intricate relationship with TSMC amidst its quest for resurgence in the semiconductor arena.

Leave a Reply